What is a VA loan?

- How Does The Va Home Loan Program Worksheets

- How Does The Va Home Loan Program Work Program

- How Does The Va Home Loan Work

VA Home Loans and How They Work. Other type of loan IF you use a Realtor familiar with the program AND a Loan Officer who is well versed in the VA program. Are Veterans Administration loans. This government insurance is a key part of how VA loans work. Without it, the program would not exist, and lenders would not be willing to finance up to 100 percent of the home. On a conventional mortgage loan that's not insured by the government, you would have to make a down payment of at least 5 percent.

Homebuyers who are considering a VA loan, but have questions, have come to the right place. Applying for a mortgage can be complicated enough even without adding a VA loan to the mix.

With so many steps, the VA loan process can sometimes feel overwhelming. In reality, the process can run smoothly if you know the basics and find a lender who’s knowledgeable and can walk you through it.

The VA loan program allows homeowners with existing VA loans the option to lower their monthly payment with a new interest rate. Eligible homeowners who financed their property with a loan other than a VA loan can refinance into the VA loan program. The purpose of the VA home loan program is to help those who served finance affordable housing. Despite its Minimum Property Requirements, the VA cannot, however, guarantee that you are making a good investment, or that you can resell the house at the price you paid. The VA loan guarantee program was especially important to veterans. Under the law, as amended, the VA is authorized to guarantee or insure home, farm, and business loans made to veterans by lending institutions. Over the history of the program, 20 million VA home loans have been insured.

Program of the government and partner NGOs with the consent of their parents or guardians and to be rescued permanently from the streets. The Ahon Bata sa Lansangan. Ahon Bata Sa Lansangan Program. 1/6/2018 0 Comments Aug 31, 2003. While DSWD secretary, she introduced the Ahon Bayan (a fund forum that seeks to match donors with the different projects of the DSWD) as well as the Ahon Bata sa Lansangan (an initiative on streetchildren). Her major thrusts then were the expansion of the Comprehensive. Bata sa lansangan. Ahon Bata Sa Lansangan Programming.. For a P5,000.00 loan from Ahon Sa Hirap, Inc. She said that expenses for meals and snacks of the working students during general cleaning activities, Christmas program for Continued on page 2. ULRC goes online with. Dapat marunong kang makibagay sa ano mang uri ng tao: bata, teenager, matanda.

Common questions homebuyers ask about VA loans include:

What benefits do VA loans offer?

Who can get a VA loan?

What are VA loan requirements?

What are the benefits of VA loans?

For eligible folks, VA loans can be the key to homeownership. In 2018, 610,512 VA loans were made with an average loan amount of $264,197. In total, the VA was responsible for $161.3 billion in mortgages last year.

Here we break down what a VA loan is and how it can help you.

What is a VA loan?

A VA loan is a mortgage that is made by private lenders, but partially backed by the Department of Veterans Affairs. There are no limits on how much you can borrow, but there are limits on how much the VA will guarantee.

One of the benefits of VA loans, also known as Veterans Affairs mortgages, is that they consistently offer lower rates than traditional bank financing, according to Ellie Mae.

Eligible borrowers may only use VA loans for their primary residence. You can’t finance an investment property or vacation home with a VA loan.

The main draw of a VA mortgage is that they make it easier to get financing by offering no down-payment loans and more lenient credit and income requirements than conventional mortgages. Once you have your certificate of eligibility or COE, you can apply for a VA home loan.

What are VA entitlements and why are they so important?

The VA guarantees a portion of your mortgage via “entitlements.” There are two types of entitlements offered to eligible veterans: basic entitlement and bonus entitlement.

The basic entitlement is $36,000 or 25 percent of the total mortgage if you default; you would get the lesser amount of the two. Generally, lenders will loan four times this amount, so you can think of the basic entitlement as a 25 percent down payment on a $144,000 home. However, you don’t have to use the full entitlement.

As home values continue to tick up, most homebuyers are faced with price tags in excess of $144,000, or the max loan amount for basic entitlement. This is where the bonus entitlement kicks in.

In 2018, the median sales price for a home hovered around $315,000, so for most VA buyers, the bonus entitlement is necessary. This is also called a second-tier entitlement.

The VA uses the national conventional financing conforming loan limit set by the Federal Housing Finance Agency, or FHFA, to establish the bonus entitlement amount. The FHFA boosted loan limits in 2019 to $484,350. In high-priced areas, the ceiling is higher at $726,525, or 150 percent of $484,350. Homebuyers can check loan limits in their area here.

The VA usually covers 25 percent of your loan amount, so eligible borrowers would get 25 percent of $484,350, which is $121,087. Then the VA subtracts the basic entitlement, which is $36,000, from the $121,087, leaving borrowers with a total of $85,087 in bonus entitlement money.

Keep in mind, lenders will generally loan VA borrowers four times the amount of the entitlement. This means you would multiply $85,087 by four, which is $340,350. Finally, you would add the $144,000 VA loan limit from your basic entitlement to the $340,350 sum which gives you a total loan limit of $484,350 — the same as the national conforming loan limit.

For homebuyers in high-cost states, the entitlement amount is larger. In counties with higher limits, the VA will guarantee 25 percent of a maximum $726,525. If your mortgage exceeds that limit, the VA won’t cover it. That means on a $900,000 home in a high-cost area, the VA will only back 25 percent of $726,525.

It is possible to use your entitlement more than one time. This depends on several factors such as how much entitlement you have left (you don’t have to use all of it when buying a house), mortgage amount and county loan limits.

The goal of VA loans is to help veterans become homeowners no matter where they live, so don’t let a costly housing market or a prior VA loan deter you from exploring this option.

What are the VA loan eligibility requirements?

Most members of the regular military, veterans, reservists and National Guard are eligible to apply for a VA loan. Spouses of military members who died while on active duty or as a result of a service-connected disability also can apply.

Active-duty military personnel generally qualify after about six months of service. Reservists and members of the National Guard must wait six years to apply, but if they are called to active duty before that, they gain eligibility after 181 days of service.

How Does The Va Home Loan Program Worksheets

You may qualify if you:

- Served 90 consecutive days of active service during wartime

- Served 181 days of active service during peacetime

- Have been an active member of the National Guard or Reserves for 6 years or more

- Are married to a service member who died in the line of duty or as a result of a service-related disability

It’s important to note that getting a COE doesn’t mean veterans qualify for a mortgage — these are two separate processes. Once you qualify for a COE, you can shop for a home loan. However, you still have to meet lender requirements which include things like income verification, credit (FICO) score, and debt-to-income ratio.

Do VA loans require PMI?

Unlike other low down-payment mortgage options, a VA loan doesn’t require private mortgage insurance. Federal Housing Administration (FHA) loans and conventional loans with less than 20 percent down require PMI, which can end up costing the borrower thousands over the life of the loan.

The benefit translates into significant monthly savings for VA borrowers. For instance, a borrower who makes a 3.5 percent down payment on a $200,000 FHA-insured mortgage would pay $100 a month for mortgage insurance alone.

What are VA loan funding fees?

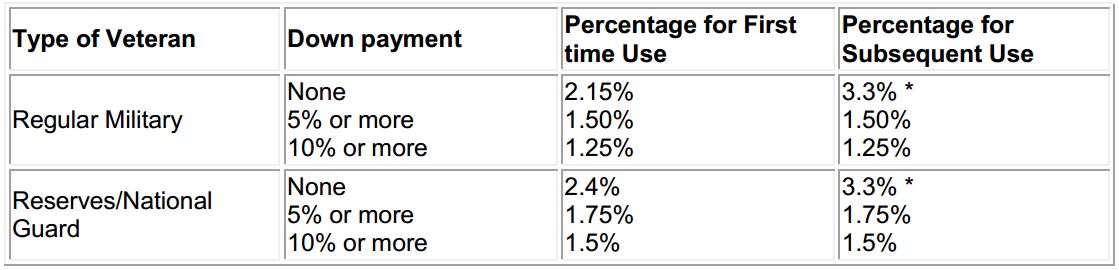

Although the costs of getting a VA loan are generally lower than other types of low-down-payment mortgages, they still carry a one-time funding fee that varies, depending on the amount of the down payment and military category. This fee helps offset taxpayers’ costs since there’s no PMI or down payment required.

A borrower in the armed forces getting a VA loan for the first time, with no money down, would pay a fee of 2.15 percent of the loan amount. The fee is reduced to 1.25 percent of the loan amount if the borrower makes a down payment of 10 percent or more. Reservists and National Guard members normally pay about a quarter of a percentage point more in fees than do active-duty members.

Those using the VA loan program for the second time, without a down payment, would pay 3.3 percent of the total loan amount.

Can existing VA borrowers lower their interest rates?

The Interest Rate Reduction Refinance Loan (IRRL) gives existing VA loan holders the opportunity to get a lower interest rate. This option requires borrowers to refinance their current VA loan into another VA loan.

The advantage of the IRRL is that credit and appraisal underwriting packages are not required. Additionally, you won’t have to pay cash out of pocket for an IRRL. It’s structured so than any fees are rolled into the new loan or the interest is adjusted so that the lender’s costs are covered.

Are there VA loan home occupancy requirements?

How Does The Va Home Loan Program Work Program

VA loans typically require borrowers to move into their home within 60 days of purchase and to use it as their primary residence. However, exceptions can be made depending on the circumstances, says Chris Birk, director of education at Veterans United.

“Lenders will evaluate occupancy scenarios on a case-by-case basis. For active duty service members, a spouse can fulfill the occupancy requirement when the military member cannot. A service member’s minor child can also satisfy occupancy in some cases,” Birk says.

Borrowers can’t use VA loans to buy investment properties or second homes.

What are VA loan underwriting requirements?

The VA doesn’t require a minimum credit score for a VA loan, but lenders generally have their own internal requirements. Most lenders want an applicant with a credit score of 620 or higher.

Borrowers must show sufficient income to repay the loan and shouldn’t have a heavy debt load, but the guidelines are usually more flexible than for conventional loans.

VA guidelines allow veterans to use their home-loan benefits a year or two after bankruptcy or foreclosure.

What are VA loan amount limits 2019?

The limit on VA loans varies by county, but the maximum guaranty amount for 2019 is $484,350 in most US counties and up to $726,525 in certain high-cost areas.

Help for struggling VA borrowers

Another advantage of a VA loan is the assistance offered to struggling borrowers. If the borrower of a VA loan can’t make payments on the mortgage, the VA can negotiate with the lender on behalf of the borrower.

VA’s financial counselors can help borrowers negotiate repayment plans, loan modifications and other alternatives to foreclosure. Regardless of whether they have VA loans, veterans who are struggling to make their mortgage payments can call (877) 827-3702 for assistance.

How to apply for VA Loan Certificate of Eligibility

Before you can apply for a VA loan, you must prove you are eligible. Applicants must get a Certificate of Eligibility (COE).

Eligible service members, veterans and spouse must meet one of the following criteria:

- You’ve served 181 days of service during peacetime.

- You’ve served 90 days of service during war time.

- You’ve had six years of service in the Reserves or National Guard.

- You are a surviving spouses of a service member who died in the line of duty.

There are three ways to apply for the COE:

Request a COE from your lender. Lenders have access to a database which can produce your COE within minutes.

Apply for the COE online at VA.Gov. You’ll have to log into your account and navigate to the COE application page.

Mail in your application. Print out this form, fill it out and include applicable proof of eligibility.

Documents required for COE:

Veterans and current or former National Guard or Reserve members in Federal active service

DD Form 214 – This must include a copy showing the type of service and the reason for leaving.

Active duty service members, Current National Guard or Reserve members who have never been Federal active service

An up-to-date statement of service signed by the adjutant, personnel office or commander of the unit or headquarters. It must include your name, Social Security number, date of birth, entry date of active duty, duration of lost time and the name of the command providing the data.

Current National Guard or Reserve member who has never been Federal active service

An NGB Form 22, report of separation and record of service for each period of National Guard service.

An NGB Form 23, Retirement Points Accounting and proof of the character of service.

Discharged member of the Selected Reserve who has never been activated for Federal active service

A copy of your latest annual retirement points statement and evidence of honorable service.

Surviving Spouse receiving DIC (Dependency & Indemnity Compensation) benefits

Submit VA form 26-1817 and veteran’s DD214 ( if available)

You must include the veteran’s and surviving spouse’s social security number on the 26-1817 form.

Surviving Spouse not receiving DIC (Dependency & Indemnity Compensation) benefits

You must submit VA form 21-534.

You must submit form DD214 (if available), which proves discharge orders.

Include a copy of your marriage license.

Include the death certificate or DD Form 1300 – Report of Casualty.

Send the VA 21-534 to the mailing address in your state. You can find that information on the following link. PMC States

How to apply for a VA loan

How Does The Va Home Loan Work

Once you have your certificate of eligibility (COE), you can apply for the VA loan. The application process is straightforward, however keep in mind that not all lenders originate VA loans. Here’s what you’ll need to do to apply:

Find a VA lender. You can do this by searching on the VA website, getting recommendations from friends or doing your own research online. Be sure to shop around for the best offer, as lender’s terms vary.

Apply for the VA loan through the lender.

Other uses for VA loan

Buying a house is just one way you can use a VA loan. Borrowers can also use VA loans in the following ways:

Cash-out refinance

Interest rate reduction refinance loan (IRRL)

Native American Direct Loan program

Adapted housing grants

Learn more:

A VA loan is a mortgageloan in the United States guaranteed by the United States Department of Veterans Affairs (VA). The program is for Americanveterans, military members currently serving in the U.S. military, reservists and select surviving spouses (provided they do not remarry) and can be used to purchase single-family homes, condominiums, multi-unit properties, manufactured homes and new construction. The VA does not originate loans, but sets the rules for who may qualify, issues minimum guidelines and requirements under which mortgages may be offered and financially guarantees loans that qualify under the program.

The basic intention of the VA home loan program is to supply home financing to eligible veterans and to help veterans purchase properties with no down payment. The loan may be issued by qualified lenders.

The VA loan allows veterans 103.3 percent financing without private mortgage insurance (PMI) or a 20 percent second mortgage and up to $6,000 for energy efficient improvements. A VA funding fee of 0 to 3.3% of the loan amount is paid to the VA; this fee may also be financed and some may qualify for an exemption. In a purchase, veterans may borrow up to 103.3% of the sales price or reasonable value of the home, whichever is less. Since there is no monthly PMI, more of the mortgage payment goes directly towards qualifying for the loan amount, allowing for larger loans with the same payment. In a refinance, where a new VA loan is created, veterans may borrow up to 100% of a property's reasonable value, where allowed by state laws. In a refinance where the loan is a VA loan refinancing to VA loan (IRRRL Refinance), the veteran may borrow up to 100.5% of the total loan amount. The additional .5% is the funding fee for a VA Interest Rate Reduction Refinance.

VA loans allow veterans to qualify for loan amounts larger than traditional Fannie Mae / conforming loans. Standard VA guidelines state that the VA will insure a mortgage where the monthly payment of the loan is up to 41% of the gross monthly income vs. 28% for a conforming loan assuming the veteran has no monthly bills, although there is no hard limit to the DTI for a VA home loan. Veteran's have been known to be approved with a DTI of up to 80%, if there are other factors that strengthen their loan application. These factors include a low Loan-To-Value (LTV), sufficient residual income, additional income received but not used to qualify for the loan, good credit, etc..

- 2Funding fees

- 3Equivalents of VA loans

History[edit]

The original Servicemen's Readjustment Act, passed by the United States Congress in 1944, extended a wide variety of benefits to eligible veterans. The VA loan guarantee program was especially important to veterans.[1] Under the law, as amended, the VA is authorized to guarantee or insure home, farm, and business loans made to veterans by lending institutions. Over the history of the program, 20 million VA home loans have been insured by the government. The VA can make direct loans in certain areas for the purpose of purchasing or constructing a home or farm residence, or for repair, alteration, or improvement of the dwelling. The terms and requirements of VA farm and business loans have not induced private lenders to make such loans in volume during recent years.

The Veterans Housing Act of 1970 removed all termination dates for applying for VA-guaranteed housing loans. This 1970 amendment also provided for VA-guaranteed loans on mobile homes.

More recently, the Veterans Housing Benefits Improvement Act of 1978 expanded and increased the benefits for millions of American veterans.[1]

Until 1992, the VA loan guarantee program was available only to veterans who served on active duty during specified periods. However, with the enactment of the Veterans Home Loan Program Amendments of 1992 (Public Law 102-547, approved 28 October 1992), program eligibility was expanded to include Reservists and National Guard personnel who served honorably for at least six years without otherwise qualifying under the previous active duty provisions. Such personnel are required to pay a slightly higher funding fee when obtaining a VA home loan.

Despite a great deal of confusion and misunderstanding, the federal government generally does not make direct loans under the act. The government simply guarantees loans made by ordinary mortgage lenders (descriptions of which appear in subsequent sections) after veterans make their own arrangements for the loans through normal financial circles. The Veterans Administration then appraises the property in question and, if satisfied with the risk involved, guarantees the lender against loss of principal if the buyer defaults.

In association with the VA's program, the Servicemembers' Civil Relief Act protects service members from financial woes on their home loan that may occur as a result of active duty commitments, freezing their interest rates at 6%.

On October 26, 2012, the Department of Veterans Affairs announced it has guaranteed 20 million home loans since its home loan program was established in 1944 as part of the original GI Bill of Rights for returning World War II Veterans. The 20 millionth loan was guaranteed for a home in Woodbridge, Va., purchased by the surviving spouse of an Iraq War Veteran who died in 2010. (www.va.gov)[better source needed]

Funding fees[edit]

A funding fee must be paid to VA unless the veteran is exempt from such a fee because he or she receives a minimum of 10% VA disability compensation. If a veteran is awarded disability compensation after paying a funding fee, he/she can apply for a refund of this funding fee, so long as the beginning date of the disability is prior to the closing date of the home mortgage.

In August 2012, Congress passed a bill that allows a Veteran to receive the benefits of having Veteran Disability while it is still pending. The amount paid for the funding fee can be refunded back to the Veteran when a determination is made and the paperwork is received.

The VA Funding fee may be paid in cash or included in the loan amount. Closing costs such as VA appraisal, credit report, loan processing fee, title search, title insurance, recording fees, transfer taxes, survey charges, or hazard insurance may not be included in the loan. However, the seller may pay these on behalf of the VA borrower.

Purchase and construction loans[edit]

Note: The funding fee for regular military first time use from 1/1/04 to 9/30/04 was 2.2 percent. This figure dropped to 2.15 percent on 10/1/04. If you have a service connected disability that you are compensated for by the VA or if you are a surviving spouse of veteran who died in service or from service connected disabilities, the funding fee is waived.

| Type of Veteran | Down Payment | First Time Use | Subsequent Use for loans from 1/1/04 to 9/30/2011 |

|---|---|---|---|

| Regular Military | None 5%-9.99% 10% or more | 2.15% 1.50% 1.25% | 3.3%* 1.50% 1.25% |

| Reserves/National Guard | None 5%-9.99% 10% or more | 2.4% 1.75% 1.5% | 3.3%* 1.75% 1.5% |

The VA funding fee can be financed directly into the maximum loan amount for the county in which the home is located. If the sales price and the financed VA funding fee total more than maximum loan amount for that county, the borrower or seller must pay for the fee out of pocket. All VA loans require an impound account for property taxes and homeowners insurance which makes the monthly payment of VA loans calculated as a PITI payment.**

Cash-out refinancing loans[edit]

| Type of Veterans | Percentage for First Time Use | Percentage for Subsequent Use |

|---|---|---|

| Regular Military | 2.15% | 3.3%* |

| Reserves/National Guard | 2.4% | 3.3%* |

- The higher subsequent use fee does not apply to these types of loans if the veteran’s only

prior use of entitlement was for a manufactured home loan.

Other types of loans[edit]

| Type of Loan | Percentage for Either Type of Veteran Whether First Time or Subsequent Use |

|---|---|

| Interest Rate Reduction Refinancing Loans | .50% |

| Manufactured Home Loans | 1.00% |

| Loan Assumptions | .50% |

- Veterans who previously lived in a home they had to then rent out will typically qualify for a no appraisal Interest Rate Reduction Refinance. The Veteran's Administration also allows Veteran Homeowners to refinance from a Conventional loan to a VA mortgage Loan. This process, however, does require an appraisal.

Equivalents of VA loans[edit]

Private mortgage insurance[edit]

Private mortgage insurance (PMI) guarantees conventional home mortgage loans - those that are not guaranteed by the government. This loan program is a private sector equivalent to the Federal Housing Administration (FHA) and VA loan programs.

The PMI company insures a percentage of the consumer's loan to reduce the lender's risk; this percentage is paid to the lender if the consumer does not pay and the lender forecloses the loan.

Lenders decide if they need and want private mortgage insurance. If they so decide, it becomes a requirement of the loan. PMI companies charge a fee to insure a mortgage loan; the VA insures a loan at no cost to a veteran buyer (other than the VA funding fee); the FHA charges a monthly fee to guarantee the loan.[1]

VA Loan application[edit]

The VA loan application is a standardized loan application form 1003 issued by Fannie Mae also known as Freddie Mac Form 65. It is a Federal crime punishable by fine or imprisonment, or both, to knowingly make any false statements on a VA loan application under the provisions of Title 18, United States Code, Section 1001, et seq.

You will need the following paperwork to apply:

- Copies of your W2 statements for the past two years, so your gross household income can be confirmed,

- Copies of your previous two pay stubs,

- Documentation of other assets (checking accounts, savings accounts, financial investments, trust funds, etc.),

- If self-employed, two years of consecutive tax returns will be required.

- The Veteran also needs to supply their DD 214 and Certificate of Eligibility (COE)

Qualifying for Veteran Home Loans[edit]

The Veteran Loan program is designed for veterans who meet the minimum number of days of completed service. Some of the other eligibility requirement for the VA loan program[2] and some specific home loan benefits include the length of service or service commitment, duty status and character of service. The program does allow for benefits to Surviving Spouses.

The VA does not have a minimum credit score used for pre-qualifying for a mortgage loan, however, most Lenders require a minimum credit score of at least 620.[3]

A Veteran who has used their entitlement to previously purchase a home, may have entitlement left to purchase another one. If you previously purchased a home using your VA Benefits then you might still have some of that “Entitlement” available to you for the purchase a new home. To Calculate Maximum Entitlement available, consider the following:

- If your previous home was purchased using a VA Loan, and that loan was paid off by the new owners, the full entitlement may have been restored.

- If you sold your home to someone, and allowed them to assume your VA Loan, then you might have the full entitlement restored, if one or more of the purchasers were also Veterans.

- If you still own the home, and you are renting it out – you might be able to purchase a new home using your partial entitlement, but there are several restrictions.

Allowable Income Sources used to qualify for a VA Loan include: Retirement Income, Social Security Income, Child Support, Alimony and Separate Maintenance, BAH, BAS and Disability Income. Dependency and Indemnity Compensation (DIC) for a Surviving Spouse can also be included. In addition, stable, documented income from employers remains the best income source for VA loans.

Homeless Veterans - The National Center on Homelessness Among Veterans (NCHAV)[edit]

The National Center on Homelessness Among Veterans (NCHAV) has planned to increase recovery-oriented care provided to homeless Veterans, or those soon to be, through the development and dissemination of evidence-based programs, policies as well as best practices. It was established in 2009 to support the execution of the U.S. Department of Veteran Affairs’ (VA’s) Five Year Plan to End Homelessness Among Veterans. This plan was born out of the goals and timeframes set forth by the legislators, governors, nonprofits, faith-based and community organizations, the U.S. Congress, the United States Interagency Council on Homelessness, business entities and philanthropic leaders to end homelessness in America and progress to make affordable and stable housing available to all its people.

NCHAV[edit]

Below are the four core activities of NCHAV’s integrated and organized work:

- Model Development & Implementation

- Research & methodology

- Education & Dissemination

- Policy Analysis[4][5]

References[edit]

- ^ abcMishler, Lon; Cole, Robert E. (1995). Consumer and business credit management. Homewood, Ill: Irwin. pp. 220–121. ISBN978-0-256-13948-8.

- ^'Eligibility Requirements'. U.S. Department of Veterans Affairs. U.S. Department of Veterans Affairs. Retrieved 2015-11-24.

- ^'VA.gov'(PDF).

- ^'Homeless Veterans'. U.S. Department of Veterans Affairs. Retrieved 19 December 2014.

- ^'Opening Doors - Federal Strategic Plan to Prevent and End Homelessness'(PDF). U.S. Department of Veterans Affairs. Retrieved 19 December 2014.